If the price of the item does not vary much, the number of units that you can will also not vary much.

However, if the price of the item varies from period to period, then you get to buy more when the prices are low, and conversely, less if the prices are higher.

This is the principle of dollar-cost averaging, or DCA, the topic for today.

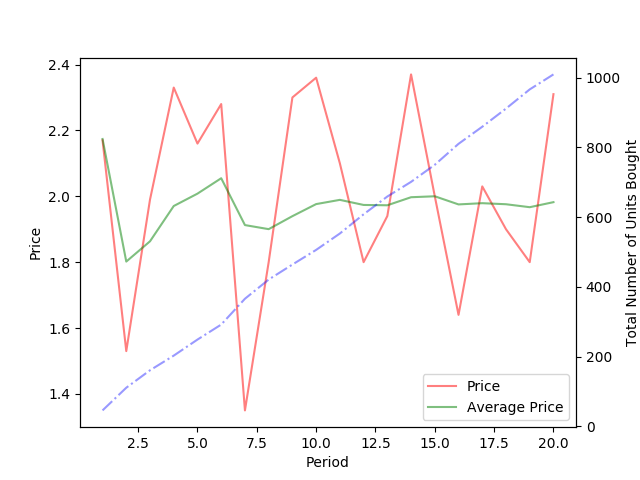

Let me illustate with some simulation and graphs. For the scenario, I am going to deploy DCA over 20 periods, each period I will spend $100 buy an item with a varying price. Prices are hypothetical and illustration purpose only.

Buy More When Prices Are Low

Well, it is expected to see that the number of units bought at each period is a mirror image of the prices.

What is the overall effect?

A Boring But Stable Cost

A cost that can be potentially lower too. The graph below illustrates.

Over a long period, the price of the units will be smoothen out, and at a level that closer to the lows. Let's see if we extend period to 100 and see the over all effects.

Do you see the average price (green line) seems to be trending down, despite the volatility of prices?

Just for completeness, over a period of 200, the average price does decrease.

Simulated Long Term Performance (Perceived)

This is an update. I reckon it might be useful to see the total value of the investment too.

The graph below shows the overall performance over period = 100.

For a period 100 timeline, the total amount invested is $10,000, as shown by the green line. As time proceeds, the number of units increases, and the overall portfolio value becomes more sensitive to the price. Nevertheless, we can see that there is a potential to exceed the invested value.

In this simulation, prices are made volatile intentionally. If an investor invests in an index funds, the prices should be more stable; he should do better the simulated case.

Last point, the simularion also shows that one should not invest in a stock whose price is so volatile; that is not the intent of the DCA to make the movement of the portfolio value like a roller-coaster ride.

Benefits of DCA

However, the simulation is based on random number generation. In the market, while this kind of price movement is not uncommon, prices are generally cyclical. Nevertheless, I am confident that this little simulation of mine iterates some very important feature of DCA.

- The DCA is a great tool for long (very long, might I add) positions - it reduces the capital outlay, smoothens out risks and it is investing on auto-pilot.

- It is especially good for investing in index funds, or ETFs that track an index, such as the STI, the STI ETF.

- It is good for discipline i investing. Many options are available in the form of a regular savings plan (RSP), such as the POSB Invest-Saver.*

The DCA is not without flaws. In sustained bullish periods, the number of units that can be bought diminishes, until prices drop, and this makes the performance of the previous purchase look extraordinarily bad. You can see this in the graph above, the first few periods where there is a spike is akin to this situation. This should not be too much of a concern though if the investor is going very long. One can simply increase the principle to invest when prices are lower to avert this situation though, but the question remains - how low is low?

One of the golden rule in investing is to keep invested. DCA is one of those tools that can help the investor to do so.

Feel free to comment!

~ZF

P/S: Simulations are performed and plotted using Python.

Afternote: I shall attempt to do a simualtion with real data soon.

No comments:

Post a Comment